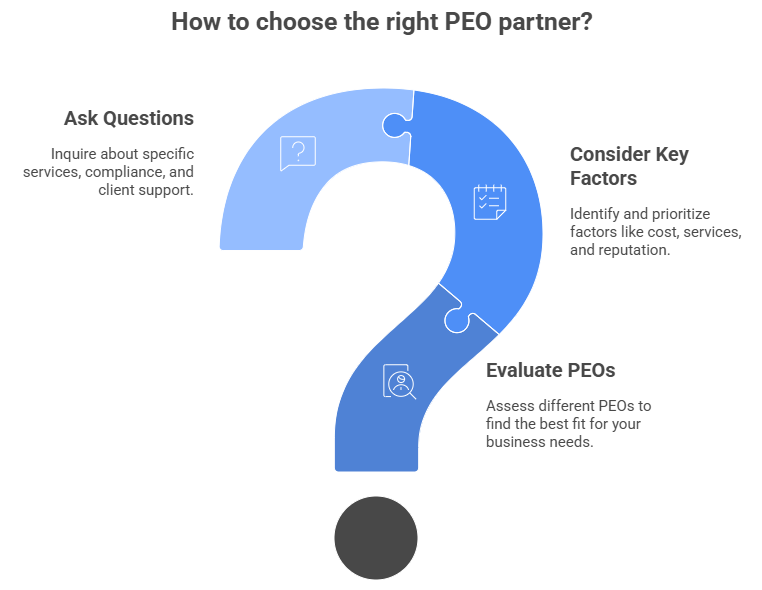

Working with a PEO allows businesses to manage employee relations tasks and obligations legitimately. There are several PEOs out there. However, it’s hard to choose the one that would work best for your business. This article goes into detail on working with a PEO partner. It outlines the procedure of choosing a PEO partner through PEO Evaluation.

Further, it talks about the most important things to consider while selecting a PEO partner. Lastly, it gets you to ask the appropriate questions before you pick one.

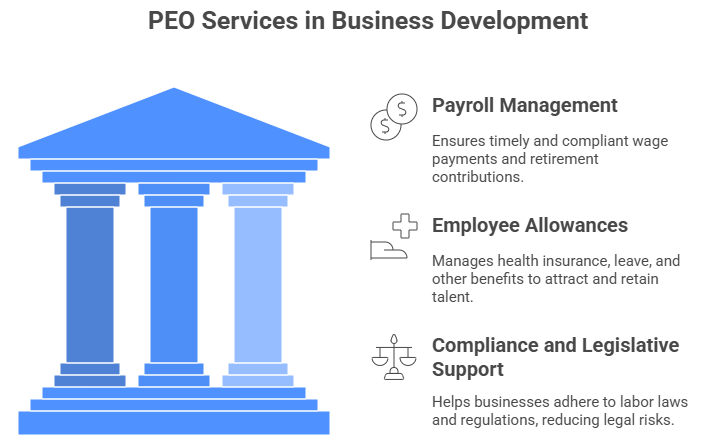

Understanding PEO Services: The PEO Role in Business Development

Professional Employer Organizations (PEOs) provide comprehensive HR solutions, including payroll, benefits, and compliance management. By outsourcing these administrative burdens, businesses focus on core operations and strategic initiatives. PEOs enable growth by giving companies access to better benefits, lowering employee turnover, and helping them attract and retain top talent.

Key Functions of a PEO in the UAE

A Professional Employer Organization for businesses has various essential functions to help you organize and manage your firm’s day-to-day tasks smoothly.

Payroll Management:

A PEO in the UAE takes care of important payroll tasks and ensures that the company complies with local labor rules. It involves timely and error-free wage payments through the Wages Protection System (WPS), administering end-of-service bonuses, and making retirement contributions as needed. A PEO also ensures that any paperwork related to payroll is legitimate.

Employee Allowances Administration:

In the UAE, PEOs take care of employee benefits, which include health insurance for staff members and their family members, as required by labor regulations. They also handle other perks, including yearly and sick leave, end-of-service funds, and other allowances like insurance. It helps organizations employ and retain the best-skilled candidates.

Remain Compliant and Legislative Support:

PEOs help with important HR compliance and regulatory issues. They ensure that companies comply with all federal and state labor rules, including visas and work permits regulations. PEOs keep up with changes in the law, lower risks, and help with labor agreements, dismissal procedures, and settling disputes. It keeps the business safe from legal consequences.

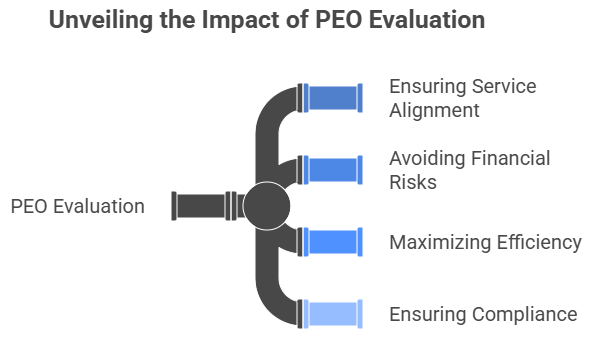

Why PEO Evaluation Matters for Your Business?

A business needs to evaluate a PEO. It ensures that the provider’s services, such as payroll, allowances, and regulatory compliance, are right for your business requirements. A thorough PEO evaluation ensures you choose a trustworthy partner who can help your business expand instead of making things more complicated.

The Cost of Working with the Wrong PEO:

If you work with the wrong PEO, you could face substantial financial and operational risks, such as expensive compliance mistakes, undesirable staff benefits, and losing control over your business’s distinctive values and hiring procedures.

How the Best PEOs Maximize Efficiency and Ensure Compliance?

The ideal PEO makes HR responsibilities easier by automating payroll and benefits management. It allows your team to focus on more important tasks, which makes the whole process more efficient. Also, a PEO’s knowledge of labor laws and rules ensures your business stays in compliance, which lowers the danger of legal problems and sanctions.

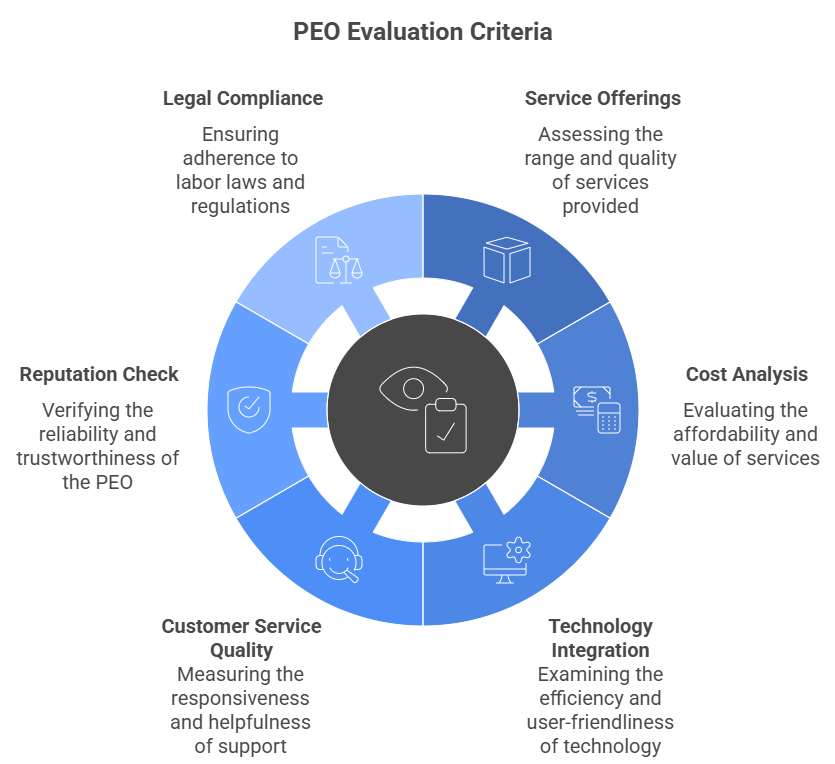

Essential Criteria to Consider for PEO Evaluation:

For effective PEO evaluation, you need to consider the services it offers, how much they cost, what kind of technology it uses, and how good its customer service is. It’s also important to check the PEO’s reputation and make sure they are following the law before forming a partnership.

UAE Labor Laws Adherence:

When looking at a PEO in the UAE, make sure they know more about the country’s labor regulations. Some important things to look for include their capacity to deal with compliance regarding the Wages Protection System (WPS). It also includes creating and enforcing legally-compliant labor agreements, visas, and work permit procedures. It ensures accurate calculations and adequate payment of end-of-service funds.

Regional Industry Experience and Market Insights:

To find out how knowledgeable a PEO is, look at how long they’ve been in the business and how well they know the market. The ideal PEO knows about the problems and rules that are unique to your industry. They will give you personalized solutions, additional advantages, and strategic advice with their specialized knowledge. It helps you stay compliant and competitive.

Service Flexibility and Scalability:

Check out a PEO to see how flexible and scalable their services are. Make sure that they offer tailored services to fulfill your business needs. They can expand with your business, adapting to changes in the number of employees and HR needs.

Technological and Reporting Skills:

When looking at a PEO, check out their technology and reporting skills. Find a platform that is easy to use and gives clear, practical information, and self-service alternatives for workers and executives. It will make HR processes more efficient and accessible.

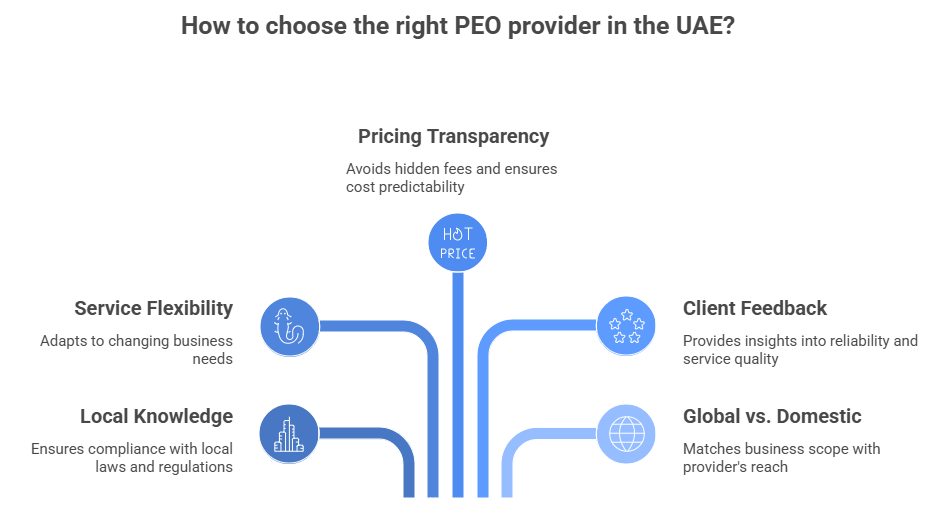

Comparing PEO Providers in the UAE: What to Look For

When looking at PEO providers in the UAE, make sure they have an established track record of local knowledge. They understand labor regulations, processing visas, and the WPS. Look at how flexible their services are, what technology they use, and how clear their prices are. Also, check their background in the sector and read reviews from past clients to make sure they are a suitable fit for your company.

Service Plans and Pricing Models:

When looking at PEO providers in the UAE, consider their service bundles and how much they charge for them. A flat price per employee is a common mode of pricing, as it makes costs easy to forecast. Another is a percentage of payroll, which goes up or down with your overall wage spend. To prevent hidden fees, look for prices that are easy to understand.

Client Feedback and Case Studies:

For proper PEO evaluation, client feedback and case studies are quite helpful. They provide you with a look at how well a supplier does in the real world. It demonstrates how reliable they are, how good their customer service is, and how well they handle complex issues.

These reviews might assist you in figuring out how knowledgeable a PEO is about your field and whether or not they can keep their promises.

Global vs. Domestic PEO Providers:

International PEOs are the best choice for businesses that operate in more than one country, as they have a worldwide reach. Local PEOs frequently possess a better in-depth awareness of the country’s particular labor laws, cultural differences, and government rules.

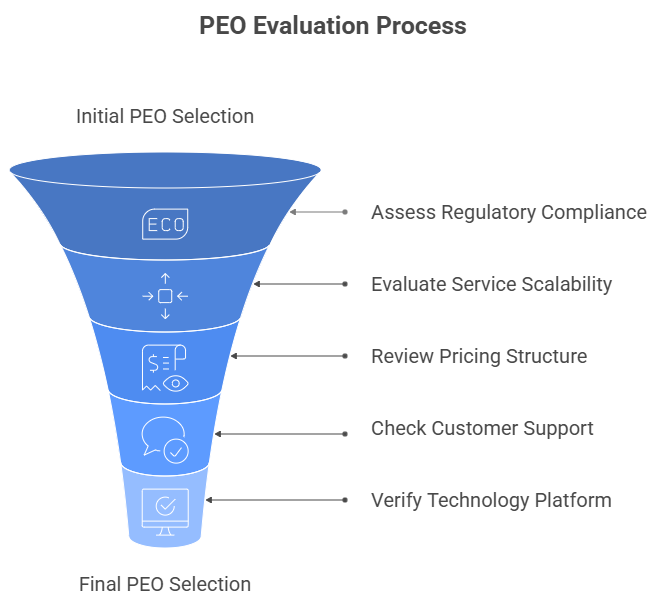

PEO Evaluation Checklist for UAE Businesses:

An appropriate PEO evaluation checklist for a firm in the UAE should assess how well a provider complies with local regulations and delivers services that can scale and adapt as the business grows. Verify the UAE PEOs’ knowledge of local labor regulations, visa processing, and payroll adherence to evaluate how proficient they are. To ensure a business runs smoothly, a checklist should include clear pricing, personalized services, and good customer service.

Questions to Ask Potential Providers:

It’s important to ask prospective PEO providers various questions about their products and services, prices, and customer service to make sure they are a good fit for your business.

Questions for Services and Expertise:

- What services do you offer in your basic plan?

- Have you worked with businesses in my field before? It ensures they know the rules and problems that are unique to your field.

- How can you make sure you follow local labor laws? A competent PEO should know a lot about the laws that apply to your business.

Questions About Pricing and Contract:

- What is the pricing structure of your services? To compare upfront costs to the percentage for payroll models, ask for a complete, detailed list.

- Are there any extra costs or hidden expenses for services like terminating an employee or getting legal help?

- What are the conditions of your agreement, and are there ending costs for the contract?

Questions About Support and Technology:

- Could we have a committed HR or account manager?

- How long does it usually take you to respond to client questions?

- Can I view a demo service of your technical platform? Make sure the software is easy to use and has the reporting features you require.

Careful Considerations:

Be careful of PEOs that don’t clearly explain their prices, have negative reviews from clients, or don’t have appropriate knowledge about UAE labor regulations. Stay away from payroll providers that don’t follow WPS rules or service contracts that aren’t clear, as they might put your organization at great risk.

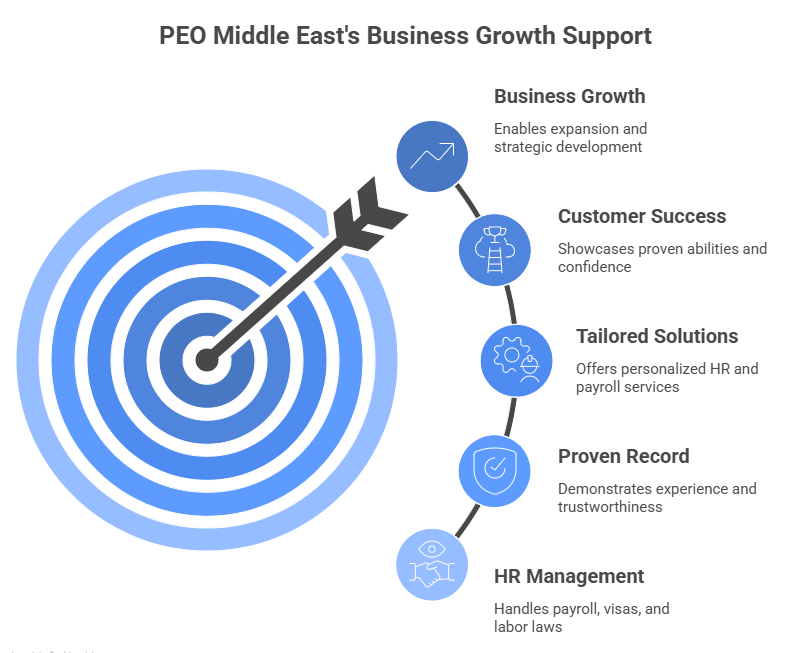

Why PEO Middle East is the Perfect Choice for Your Business?

If you want to grow your business in the UAE, PEO Middle East is the best choice. They expertly handle challenging HR chores, like WPS-compliant payroll, visa processing, and adhering to local labor laws. It lets you focus on growing your business.

Proven Record in the Region:

PEO Middle East has a solid track record in the UAE and GCC and can help you manage complicated labor regulations, process visas, and pay your employees in a way that complies with WPS. Their long experience of working with clients and their established presence in the area show that they are trustworthy and can help businesses grow smoothly by the law.

Tailored Solutions:

PEO Middle East is the best choice because it offers customized HR, payroll, and execution solutions. They offer personalized services that fit your business demands, making sure everything runs smoothly while efficiently dealing with complicated local rules and paperwork.

Success Stories of Customers:

The success stories of PEO Middle East’s clients show how well they can deal with complicated rules in the UAE. Their proven abilities give enterprises the confidence to develop and strategically expand without obligations in the region.

Final Words:

Proper PEO Evaluation for businesses gives you a strategic edge. It’s not enough to just provide them jobs, you have to work together to flourish. A thorough study that uses a checklist to look at regional expertise, compliance record, and service accountability can turn a simple decision into a huge economic opportunity.

If you hire the wrong PEO, one that doesn’t keep up with changes in the law, your firm could face significant hazards, fines, and challenges with day-to-day operations. The right partner, such as PEO Middle East, has the knowledge to help you negotiate the complicated landscape of the UAE. To get started, just call for a consultation to make sure their custom solutions fit with your business’s objectives.