In today’s fast-moving business world, staying compliant with UAE labor regulations while managing payroll efficiently is not optional—it’s essential. From startups in Dubai to enterprises in Abu Dhabi, every UAE business needs reliable software that simplifies payroll processes, ensures legal compliance, and saves time. That’s why understanding the payroll software features that matter most in 2025 is crucial.

This comprehensive guide breaks down the must-have functionalities of modern payroll systems tailored for UAE businesses. Whether you’re managing a lean HR team or overseeing multiple departments, the right payroll solution can transform your entire back office.

Why Choosing the Right Payroll Software Matters in the UAE?

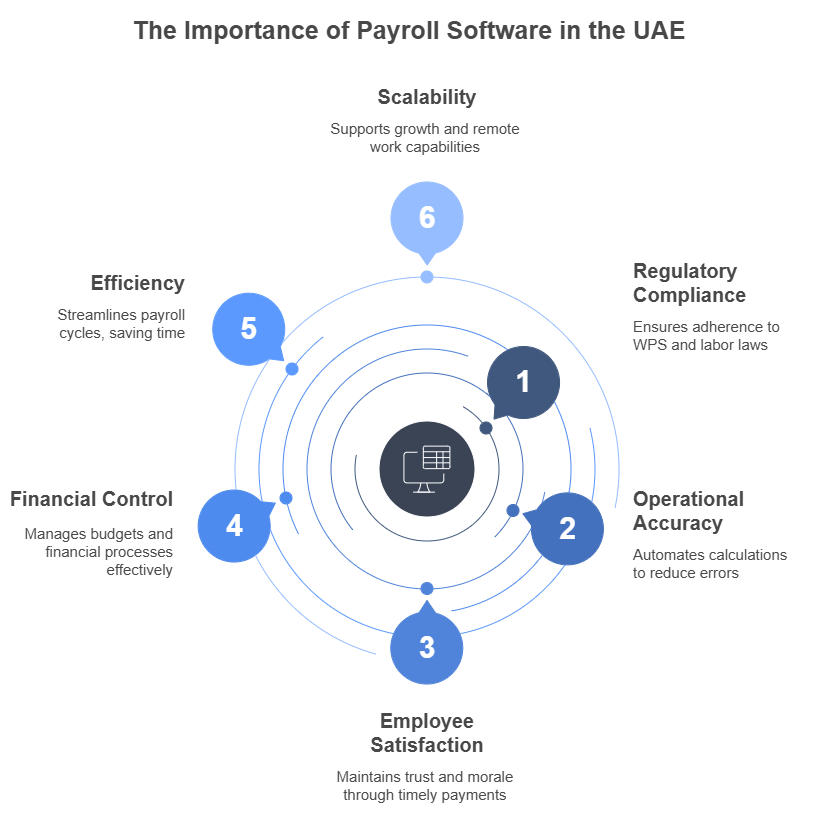

The UAE has unique payroll and labor regulations, including the mandatory Wage Protection System (WPS), gratuity calculations, multi-currency payments, and end-of-service benefits. Choosing the right payroll software isn’t just about paying employees on time—it’s about ensuring:

- Regulatory Compliance

- Operational Accuracy

- Employee Satisfaction

- Financial Control

Let’s break this down further:

Key Reasons to Prioritize the Right Payroll Software:

| Reason | How It Helps UAE Businesses |

| Compliance | Adheres to WPS, labor laws, tax regulations, and end-of-service policies. |

| Accuracy | Automates salary, leave, and benefit calculations to reduce errors. |

| Efficiency | Streamlines payroll cycles, saving HR teams hours of manual work. |

| Scalability | Supports growing teams and remote staff with multi-location capabilities. |

In short, the features of payroll management system you choose directly impact legal standing, employee trust, and your ability to scale sustainably.

Core Payroll Features UAE Businesses Can’t Afford to Miss:

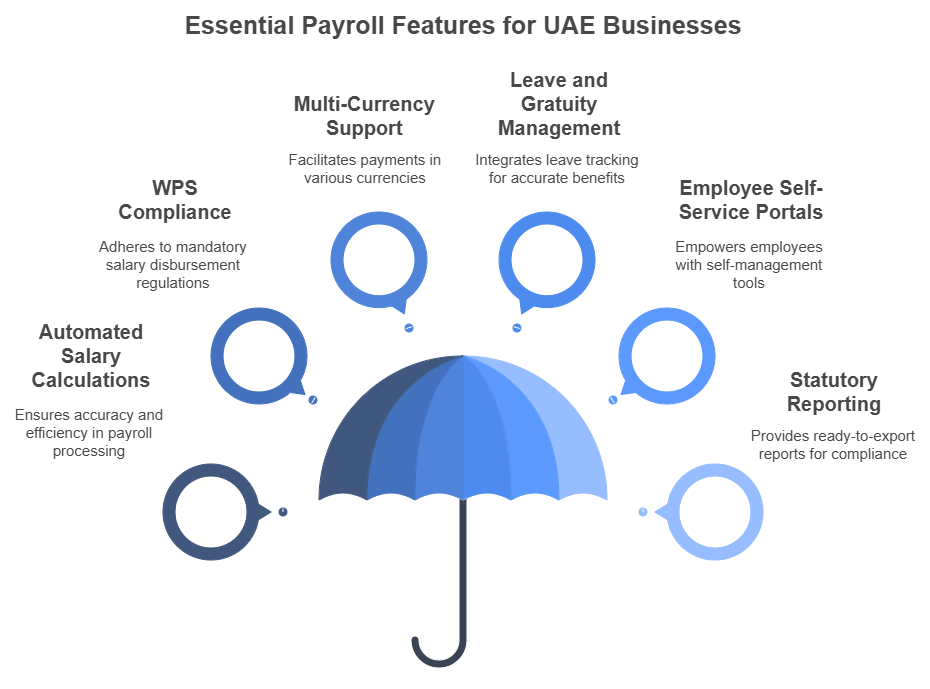

Modern businesses in the UAE require payroll systems that go beyond basic functions. These are the core payroll features every business should look for:

Automated Salary Calculations and Deductions:

Manual calculations increase the risk of errors and legal issues. Your payroll software should:

- Automatically calculate gross-to-net salaries

- Apply statutory and voluntary deductions (like GOSI, fines, or allowances)

- Adjust payments based on working hours, overtime, or unpaid leave

Automation ensures payroll is fast, accurate, and audit-ready every time.

WPS (Wage Protection System) Compliance:

WPS is a mandatory regulation in the UAE requiring employee salaries to be processed through authorized banks and exchange houses. Payroll software must:

- Generate SIF (Salary Information Files) in the required format

- Schedule compliant salary disbursements

- Provide alerts on pending or failed WPS transfers

This feature isn’t optional—it’s essential for avoiding penalties.

Multi-Currency and Localized Payment Support:

If your business operates across GCC countries or employs foreign nationals, you need:

- Support for AED and foreign currencies (USD, EUR, INR, etc.)

- Localized payment processing (e.g., direct bank deposits or exchange center payouts)

- Currency conversion tracking for transparent reporting

HR and payroll software features that adapt to the UAE’s diverse workforce help maintain smooth operations.

Leave and Gratuity Management Integration:

UAE labor law mandates specific calculations for:

- Annual leave accrual

- Sick leave

- Maternity/paternity leave

- Gratuity/end-of-service benefits

Your payroll system must integrate seamlessly with leave tracking to auto-calculate accurate entitlements and benefits.

Employee Self-Service Portals:

Empowering your team improves morale and reduces HR workload. Self-service portals should allow employees to:

- Download payslips.

- Submit leave requests.

- Update personal data.

- View payroll history.

This not only improves transparency but eliminates constant back-and-forth between staff and HR.

Statutory Reporting and End-of-Service Benefits Tracking:

From end-of-year audits to government inspections, you’ll need accurate reports on:

- Employee salaries and bonuses.

- Gratuity calculations.

- Termination settlements.

Choose a system that provides ready-to-export statutory reports aligned with MOHRE and free zone requirements.

Advanced Features That Set Great Payroll Software Apart:

Beyond the basics, the best systems offer intelligent features that future-proof your HR operations.

Real-Time Analytics & Payroll Insights:

Today’s top payroll tools offer dashboards that provide:

- Payroll cost breakdowns by department.

- Attendance-to-pay insights.

- Trends in overtime, leave, and allowances.

With real-time analytics, you can make smarter HR and budgeting decisions.

Customizable Payslips and Document Automation:

Professionalism counts. Look for software that allows:

- Custom branding on payslips.

- Multiple language options (English/Arabic).

- Automatic generation of salary certificates, contracts, and NOCs.

Automation also reduces paperwork errors and ensures timely delivery.

Seamless Integration with HR & Accounting Tools:

The payroll system should integrate with:

- HRMS (for attendance, leave, employee data)

- Accounting software (QuickBooks, Xero, Tally, Zoho Books)

This ensures real-time syncing, error-free ledger entries, and smooth financial audits.

Cloud Access with Enterprise-Grade Security

In 2025, cloud-based payroll is the standard. Benefits include:

- Remote access for HR/admin teams

- Automatic updates and backups

- Role-based access controls

- End-to-end encryption and multi-factor authentication

Top systems also offer disaster recovery and GDPR-compliant data privacy controls.

PEO Middle East: Leading Payroll Software & Outsourcing Partner in the UAE:

At PEO Middle East, we understand the local compliance landscape, technology trends, and operational needs of UAE businesses. Our payroll software and outsourcing services are tailored for startups, SMEs, and enterprises looking for a competitive edge.

Here’s how we simplify payroll for businesses across Dubai, Abu Dhabi, Sharjah, and beyond:

UAE Labor Law Expertise Built Into Our Platform:

Our solution is designed to reflect the latest UAE laws, including:

- WPS file formatting and submission

- End-of-service benefits tracking

- Gratuity auto-calculations by contract type

This legal alignment reduces the risk of non-compliance and saves hours of manual calculations.

End-to-End Payroll Outsourcing for Hassle-Free Compliance

Don’t have an in-house HR or finance team? No problem.

We offer:

- Complete payroll processing

- Employee record management

- Payslip distribution and WPS submissions

- Government reporting and audits

Let us handle your payroll so you can focus on growth.

Scalable Solutions for Growing Teams and Expanding Operations

Whether you’re hiring your 5th or 500th employee, our platform grows with you:

- Add/remove employees with one-click setup

- Support for multi-location branches

- International contractor and remote staff payment support

Our solutions scale as your business evolves, keeping your operations flexible and future-ready.

Ready to Simplify Payroll? Let PEO Middle East Guide Your Next Step

Choosing the right payroll features for your UAE business isn’t just a technology decision—it’s a growth strategy.

From automated salary calculations to WPS compliance, every functionality matters. And with PEO Middle East, you don’t just get software—you get a trusted compliance and payroll partner.

Let’s take the next step together.

✅ Book a free payroll consultation

✅ See a live demo of our HR & payroll software features

✅ Explore full-service payroll outsourcing for your business

The UAE’s business environment is competitive and compliance-driven. Having payroll software that includes essential features like WPS support, gratuity tracking, and cloud security can set your business up for success.

To recap, here’s a checklist of essential payroll software features for UAE businesses in 2025:

| Must-Have Feature | Purpose |

| Salary Automation | Faster, error-free payments |

| WPS Compliance | Legal adherence |

| Gratuity & Leave | End-of-service and paid leave accuracy |

| Multi-Currency | Payment flexibility |

| Self-Service | Employee independence |

| Reporting Tools | Compliance and insights |

| Cloud Access | Flexibility and security |

If you’re ready to stop worrying about payroll and start focusing on your people and profits—PEO Middle East is here to help.