Getting even one digit wrong while running payroll can change the entire outcome. Small business owners in the UAE already wear too many hats. And payroll shouldn’t be another stress point on top of all that. That’s why payroll outsourcing for small businesses has become a strategic move that saves time, reduces risks, and improves accuracy.

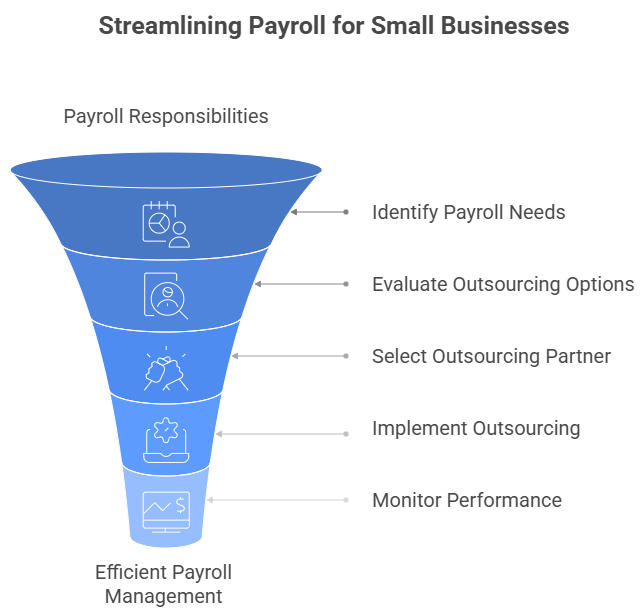

Outsourcing payroll means handing over your payroll responsibilities of salary calculations, benefits, deductions, and compliance to experts who live and breathe this process. In this blog post, we cover this topic in detail so small businesses can use it as a guide.

Payroll Outsourcing for Small Businesses:

Every successful business owner knows that time and money are the two things to never be wasted. And that’s why most entrepreneurs often look for smarter ways to run their operations. So if you are running a small business in the UAE, you have probably felt the drain of spending hours on payroll instead of growing your company.

Payroll outsourcing for small businesses isn’t a luxury. It is quite often a life saver. Instead of getting buried in calculations, paperwork, and government updates, you can hand it over to experts who do this every single day. That’s why many SMEs in the UAE are already using payroll outsourcing services in UAE. And in the next few sections later in this blog post, you will see exactly why it works.

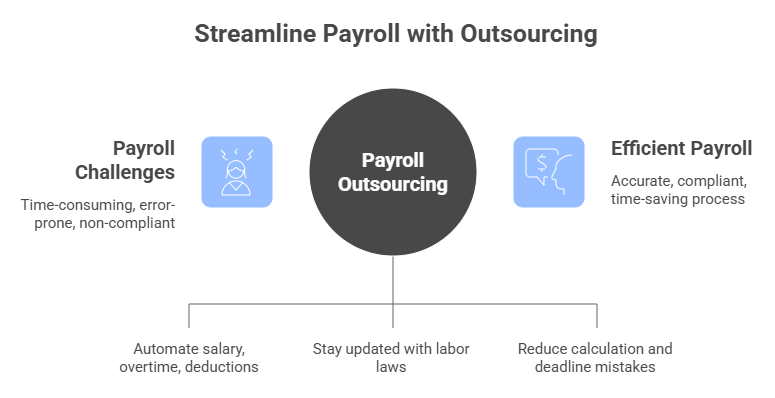

Common Payroll Challenges Faced by Small Businesses:

Before getting into a lot more details about how payroll outsourcing works, we want to address some of the common challenges that most small businesses are faced with.

Because payroll might look simple at first glance, but once you start managing it, things tend to pile up pretty quickly. Most small businesses in the UAE discover that the hours spent on spreadsheets could have been better invested elsewhere. These are some of the most common hurdles:

Time Consuming Payroll Calculations:

Even small teams generate complex payroll requirements. Manually calculating salaries, overtime, and deductions takes valuable hours every month. When you only have a lean team, every hour spent on payroll is an hour not spent on winning clients or growing revenue.

For a business owner, this means spending hours on something that doesn’t directly grow revenue. Outsourcing can help you get those hours back.

Compliance with UAE Labor Laws:

UAE has specific labor laws and updates that employers must follow. Missing a rule can create big consequences. Small businesses without a dedicated HR team often find it overwhelming to keep up. We’ve covered more on this in our UAE Labour Law guide.

Risk of Payroll Errors:

A single mistake in salary calculation or missed deadline can damage trust with employees. In some cases, it can even cause legal trouble. Errors aren’t just numbers gone wrong. They can negatively affect your workforce’s morale, retention rates, and even your own business reputation.

These challenges highlight why so many businesses are shifting toward payroll outsourcing solutions. But how does the process actually work? Let’s break it down.

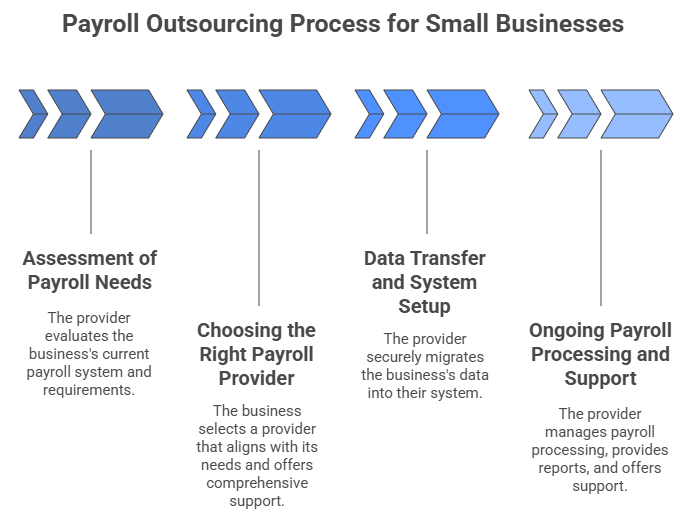

How Payroll Outsourcing Works for Small Businesses?

Payroll outsourcing might sound complex, but in reality, the process is simple once you understand the flow.

Step 1 – Assessment of Payroll Needs:

The provider starts by looking at your current system. How many employees do you have? What’s your pay cycle? Do you provide allowances or bonuses? This step ensures the service is customized to your business.

Step 2 – Choosing the Right Payroll Provider:

Not all payroll companies are created equal. Some focus only on processing numbers, while others (like PEO Middle East) provide ongoing support, compliance advice, and even HR consulting. Picking the right partner is the difference between outsourcing and truly upgrading your payroll.

Step 3 – Data Transfer and System Setup:

Once you choose a provider, they migrate your data into their system. That includes employee details, contracts, salary structures, and benefits. Don’t worry. This process is designed to be secure and seamless.

Step 4 – Ongoing Payroll Processing and Support:

After setup, payroll is processed on time every month. You also receive regular reports, compliance updates, and direct support if issues arise. In short, your payroll moves from being your responsibility to being managed by professionals.

Now, the big question: why should you consider payroll outsourcing for business growth instead of keeping things in-house? The benefits speak for themselves.

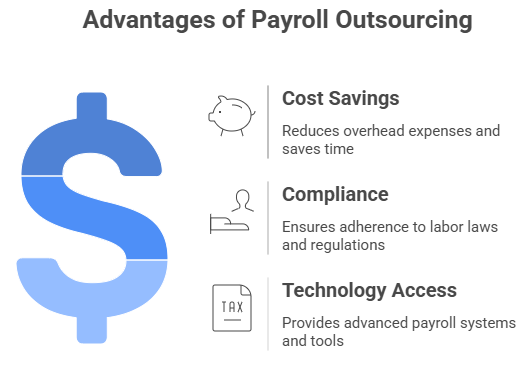

Benefits of Payroll Outsourcing for Small Businesses:

When you outsource payroll, you’re not just buying a service. You are freeing your time, protecting your business, and giving your employees a better experience.

Cost Savings and Operational Efficiency:

Hiring a full-time payroll manager or HR team can be expensive. Outsourcing gives you expert service without the overhead costs. More importantly, it saves you time that can be invested back into sales, marketing, and strategy.

Better Compliance and Reduced Legal Risks:

Outsourcing providers keep track of labor law changes and make sure your payroll matches the latest requirements. Instead of worrying about penalties or errors, you can relax knowing compliance is built into the process.

Access to Payroll Technology and Expertise:

Outsourcing gives you access to advanced payroll systems that small businesses wouldn’t usually invest in. From digital payslips to automated calculations, you get tools that simplify management. (We’ve explained more about this in our blog about HR and Payroll Consulting in UAE).

With these benefits in mind, how do you pick the right partner in the UAE? That’s what we’ll cover next.

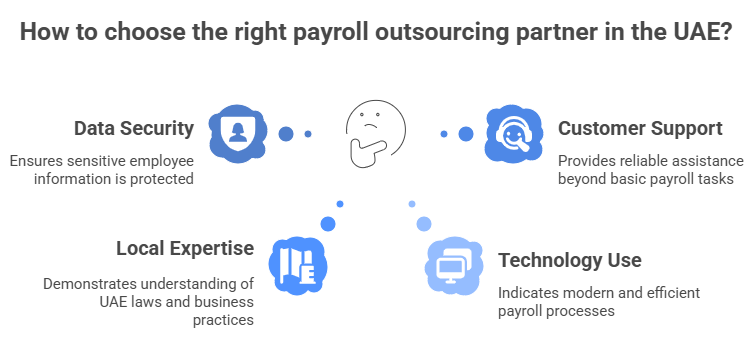

Choosing the Right Payroll Outsourcing Partner in the UAE:

Choosing a payroll partner is a decision you don’t want to rush. The provider you select will directly impact employee satisfaction and compliance.

When assessing potential partners, ensure they follow recognized data security standards such as ISO/IEC 27001 to protect sensitive employee information. It’s also wise to confirm that the provider is listed in a verified UAE business directory like the Dubai Chamber, which reinforces credibility and trust.

Factors to Consider:

Look at their experience with UAE businesses, their understanding of local laws, and the technology they use. Do they have proven results? Do they provide customer support beyond just sending payslips?

Questions to Ask Before Hiring:

Ask how they secure employee data. Ask about their response time when an issue arises. Ask what reporting and support you’ll receive monthly. The more transparent the answers, the more confident you’ll be in the decision. You can learn more about how we do this on our About PEO Middle East page.

Cost of Payroll Outsourcing for Small Businesses:

One of the most common questions we hear is: “How much does payroll outsourcing cost?” The answer is: it depends.

Factors like the number of employees, the services you require, and the pay cycles you choose will all affect pricing. Comparing in-house payroll vs outsourcing shows that while in-house may look cheaper upfront, it quickly becomes costly once you factor in salaries, training, errors, and time. Outsourcing gives you a predictable cost and professional support, without the hidden expenses.

Payroll Outsourcing and Business Growth:

Small business owners often wear multiple hats. By outsourcing payroll, you take one of those hats off and free yourself to focus on scaling.

For example, imagine a growing cafe in Dubai. The owner used to spend weekends processing staff wages, calculating overtime, and double-checking compliance updates. After outsourcing, payroll became automatic, freeing the owner to expand menu options, negotiate better supplier deals, and even plan for a second branch. That’s the difference outsourcing can make.

Conclusion:

Payroll outsourcing for small businesses in the UAE is more than just delegation. It’s about giving your business the structure it needs to grow without distractions. From saving time and reducing risks to improving employee satisfaction, the benefits are clear.

At PEO Middle East, we provide tailored payroll outsourcing solutions that meet the specific needs of small businesses. If you’re ready to simplify payroll and focus on growth, contact us today and let us help you make payroll the easiest part of running your business.