If you’re in Bahrain and haven’t kept up with the labor law updates, then what are you even doing? 2025 is the year to get your compliance game tighter than ever. But don’t worry—this isn’t only about avoiding penalties (though that’s a huge plus). This is about keeping your operations smooth, your employees happy, and your reputation intact.

The beauty of Bahrain labor law? They’re clear. The trick? Staying ahead of what’s coming, especially as these laws evolve with new regulations. So let’s break it down—no sugarcoating, only the essentials.

- Your Compliance Checklist for Staying Ahead of the Game

- Nationalization Requirements: The Bahrainization Push

Hiring with Bahrain’s New Nationalization Push: A Local Advantage You Can’t Ignore

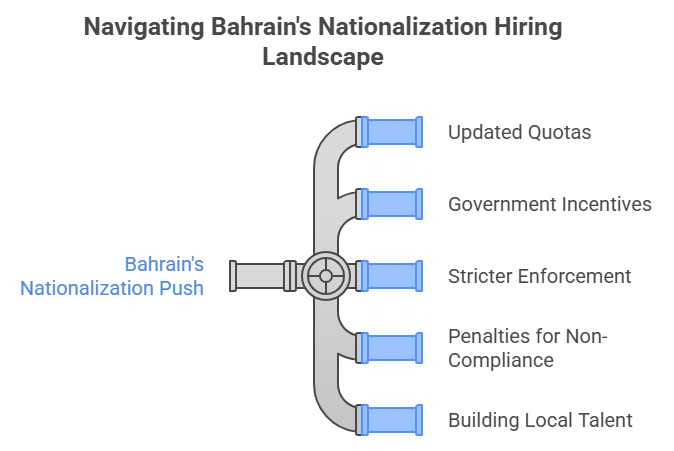

Bahrainization—aka ensuring more Bahraini nationals get hired in private companies—is in full swing. Here’s what’s new:

– Updated quotas for Bahraini employees in certain industries (fines for non-compliance).

– More government incentives for hiring and training Bahraini workers.

– Stricter enforcement of job market tests before hiring expats.

Translation? You can’t only default to hiring expats. If a Bahraini can do the job, you’d better have a solid reason for hiring someone else—or you might run into permit issues.

Hiring local talent is the future, and Bahrain is seriously investing in its workforce. But let’s get something straight: this isn’t about a do it or else situation. Not when this is about leveling up. Hiring Bahraini nationals isn’t a regulatory requirement. Take this as an opportunity instead to inject fresh perspectives, talent, and energy into your business.

If you’re still thinking expats first, you might want to rethink. Bahrain’s nationalization quotas (i.e., hiring more local talent) are here, and they mean business. You can’t afford to ignore this. Here’s why:

- Penalties are real. Missing nationalization quotas can land you with serious fines and even force you to scale back your workforce.

- Training programs can get you government incentives to hire locals. And trust us—free training isn’t a bad deal.

- Building local talent means investing in the future of your business. Stop viewing local employees as a compliance checkbox and start seeing them as your business partners.

Start building your talent pipeline now. Not only will this keep you in compliance, but it will also boost your company’s reputation as a business that genuinely cares about Bahrain’s development.

The Push to Hire Locals

Ah yes, Bahrainization. It’s the government’s push to get more Bahraini nationals into the private sector. Now, it’s not only a suggestion, it’s obligatory.

If you’re running a business in Bahrain, you’ll need to keep an eye on your nationalization quotas for employees. These quotas vary by industry, but the principle remains the same: hire Bahraini workers.

Here’s the deal:

– If your business doesn’t meet the required quotas, you’ll face penalties.

– Failure to prove that you couldn’t find qualified Bahrainis for certain roles? That could lead to further scrutiny.

– Bahrain is offering incentives for businesses that hire and train local talent—so take advantage of those.

In short, if you’re planning to hire expats in 2025, make sure you’ve got your Bahrainization strategy locked down—or risk running into a compliance mess.

Hiring? Better Make It Bahraini-Friendly

Bahrain is doubling down on its workforce nationalization efforts, and if your hiring strategy doesn’t include local talent, you might hit some roadblocks. The government is pushing for more Bahrainis in the private sector with incentives, training, and stricter employment ratios. Translation? If you’re hiring, think local first—or risk compliance headaches.

Employee Benefits:

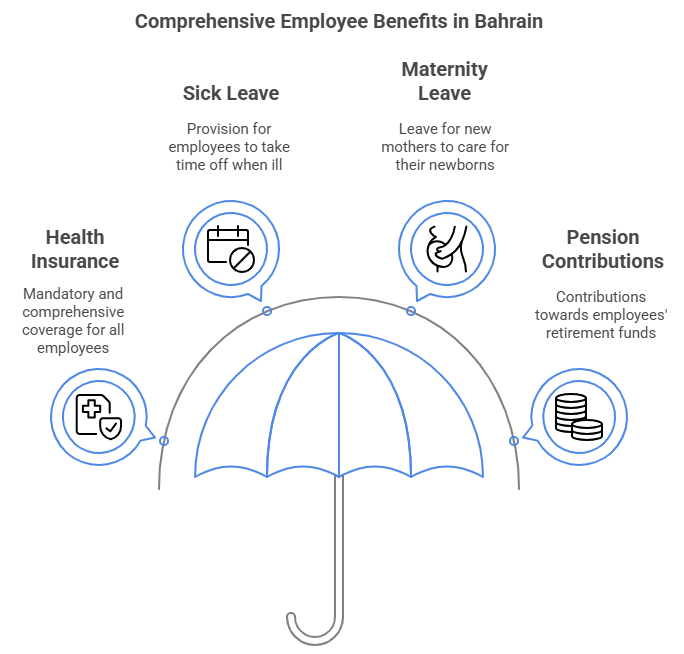

Bahrain isn’t only asking you to pay employees a decent salary anymore—it’s about making sure you’re offering the right benefits. We’re talking about health insurance, sick leave, maternity leave, and pension contributions. You can’t play favorites here, and your benefits package needs to be more than only a nice idea.

Health Insurance: Mandatory and Growing

If you’re still one of those businesses that are treating health insurance as some sort of optional perk, it’s time to correct your course. Health insurance for Bahraini employees is compulsory, and we aren’t talking about basic coverage. Bahrain’s pushing for comprehensive coverage—we’re talking everything from preventative care to mental health services.

If your health insurance coverage doesn’t meet the legal requirements, you’ve got a problem. And remember, this isn’t something that’s going to go away on its own.

- For nationals: Health insurance is non-negotiable—if you’re not offering it, the penalties are hefty.

- For expats: Yes, you need to offer health insurance too, but there are additional requirements on the horizon for expat coverage, so don’t wait until the last minute to upgrade your plan.

Paid Time Off: Because Burnout Isn’t a Flex

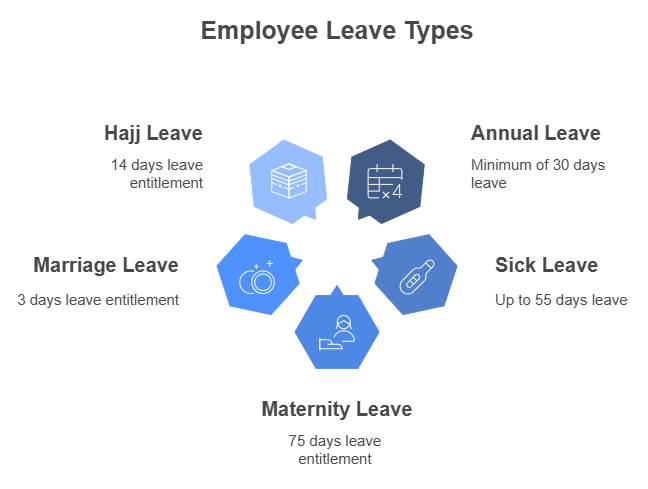

- Annual leave: At least 30 days

- Sick leave: Up to 55 days. Get ready to pay for sick days—and that’s full pay for the first 10 days, then half pay for the next 20, and finally, you can leave it up to the employee for the remainder.

- Maternity leave: A generous 75 days—60 of which are paid and 15 are unpaid.

- Marriage leave: 3 days

- Hajj leave: 14 days (for Muslim employees, once every five years).

Sick Leave: Cough, Cough—But Make It Official

If an employee is unwell, here’s what they’re entitled to:

- 15 days fully paid

- 20 days half pay

- 20 days no pay

But don’t try to get clever—abusing this system could get both employees and employers in trouble. Keep the records straight, and don’t forget that medical documentation is your best friend.

Maternity Leave: Moms Get a Break, and You Get a Reality Check

- 75 days total: 60 fully paid, 15 unpaid.

- Women cannot work for 40 days post-delivery—no exceptions.

So if you’re an employer still thinking maternity leave is “optional,” consider this your official wake-up call.

Leave Entitlements: Get It Right or Face Consequences

Sick leave, maternity leave, annual leave—Bahrain labor law is quite clear on this. So if you’ve been lax about managing time off, don’t make this your weak link in 2025.

What happens if you skip these? Expect fines, employee disputes, and a seriously tarnished reputation.

Termination:

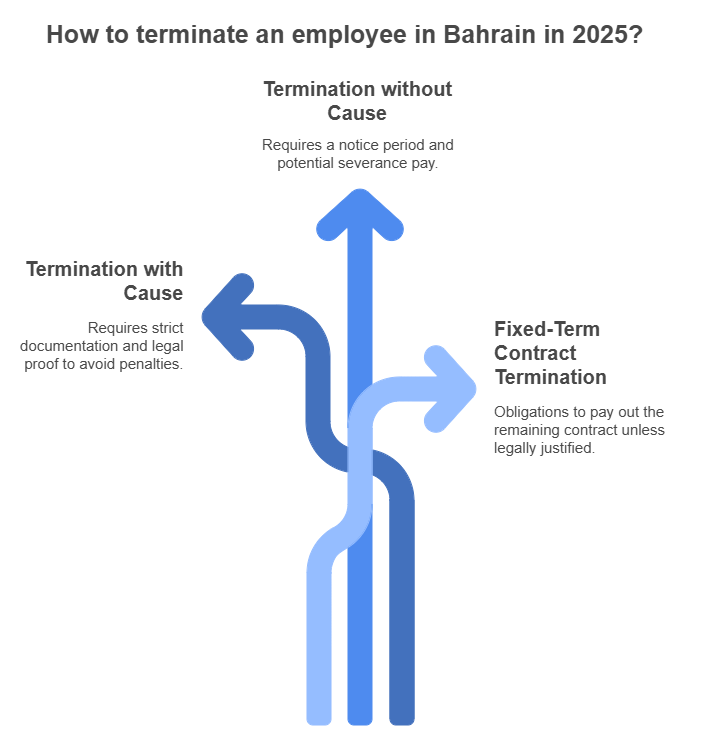

Termination isn’t something you do on a whim—especially not in 2025. Bahrain labor law has placed heavy restrictions on dismissing employees without proper cause, and the penalties for unfair dismissal are enough to make your jaw drop.

So, let’s break it down:

- Notice period: You need to give employees written notice (we’re talking at least a month) before termination unless you have a just cause for firing them on the spot.

- Termination with cause: There are very strict guidelines on what counts as justifiable grounds for firing someone. Think criminal conduct or serious breaches of contract. If you can’t prove that in court, be prepared to pay the employee for the full term of their contract—and sometimes even more.

This is why documentation and communication are key. Every time an issue arises, document it. Have a paper trail. And be prepared to show evidence that your decision to terminate was justified.

Firing Someone? Read This Before You Regret It

Terminating employees in Bahrain isn’t as simple as saying you’re fired.

- Indefinite contracts: 2 days’ pay per month worked, minimum 1 month’s salary, max 12 months.

- Fixed-term contracts: You owe the employee whatever’s left on their contract (unless there’s a legal reason for termination).

If you don’t follow the rules? Get ready to fund an employee’s vacation with a severance payout.

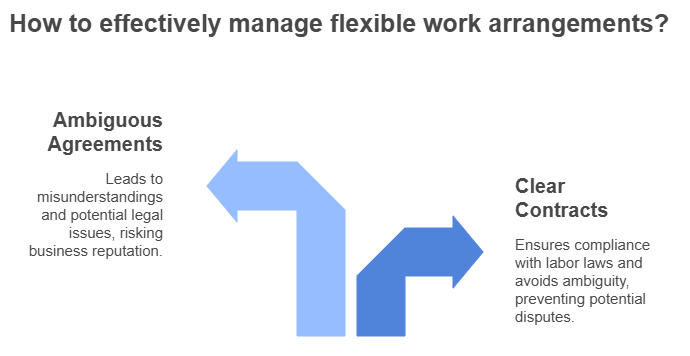

Flexible Work: Get It Right or Get Left Behind

Work culture is changing, and it’s changing fast. Remote work, hybrid schedules, and flexible hours aren’t only trendy, they’re becoming the norm. But it’s not the time to get too comfortable. Bahrain labor law requires that these arrangements be clearly outlined in written contracts.

Your remote workers and hybrid employees aren’t only “working from home” anymore—they need clear agreements on things like:

- Work hours: How many hours are they working?

- Deliverables: What are the expectations for productivity?

- Location: Are they working from Bahrain or another country?

It may sound like a small thing, but this is a huge area where businesses often slip up. Ambiguity = problems, especially when an employee tries to claim they’re entitled to more benefits or pay for their work-from-home days.

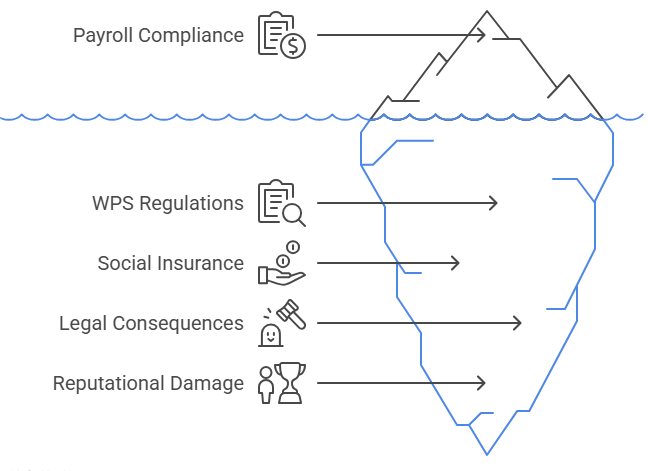

Payroll and Salary Deductions: It’s Not Only About Paying on Time

Ah, payroll. The silent but deadly compliance issue. You think you’re doing it right—paying salaries on time, doing the WPS thing, and offering overtime—but then suddenly, there’s an issue, and it’s too late to backtrack.

The Wages Protection System (WPS)

The WPS is your safety net, but it’s not infallible. Here’s what you absolutely cannot afford to forget:

- All salaries must be paid through registered Bahraini banks—no exceptions.

- Salary records must be meticulously documented and maintained.

- Overtime should be tracked and paid at the correct rate—25% extra, minimum.

Don’t think of the WPS as a simple paycheck process—it’s a system that’s scrutinized by authorities.

Payroll & Social Insurance: No Shortcuts, No Excuses

- Bahraini employees: Employer pays 12%, employee pays 7%.

- Expats: Employer pays 3%, employee pays 1%.

- Extra 1% unemployment insurance for everyone.

Messing this up? Not an option. Payroll process in Bahrain is tightly regulated, and missing payments can land you in serious trouble.

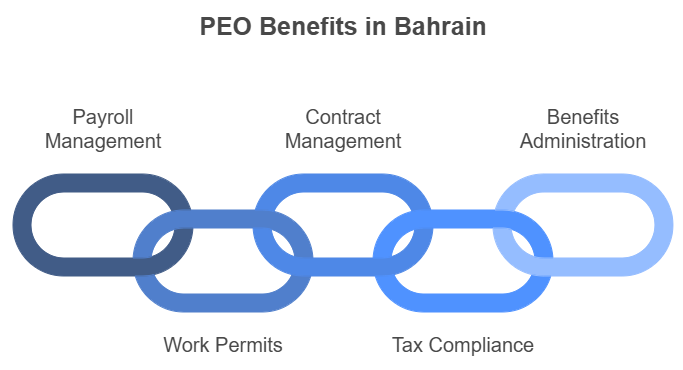

Don’t Forget About the Power of PEOs

So, here’s the deal: managing all of this alone? That’s like trying to juggle knives. Sure, it can be done, but it’s way more efficient (and less dangerous) when you let someone else handle the heavy lifting.

A PEO in Bahrain (or PEO Middle East) isn’t only about outsourcing HR functions—it’s about getting the expertise and resources you need to stay compliant, competitive, and on top of evolving regulations. With a PEO handling:

- Payroll

- Work permits

- Contract management

- Tax compliance

- Benefits administration

You can focus on what matters—growing your business, scaling operations, and crushing the competition without the fear of falling into compliance trouble.

Employment Contracts:

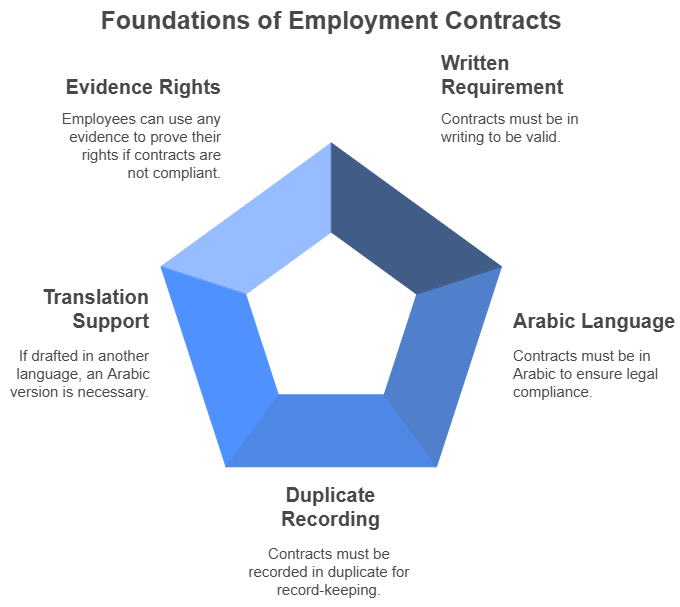

Handshake agreements won’t cut it. Employment contracts must be in writing, in Arabic, and recorded in duplicate. If you’re feeling fancy and drafting contracts in another language, make sure you have an Arabic version to back it up. Otherwise, an employee can prove their rights using any means of evidence—and that’s a legal headache you don’t want.

Working Hours: The 9-to-5 Glow-Up

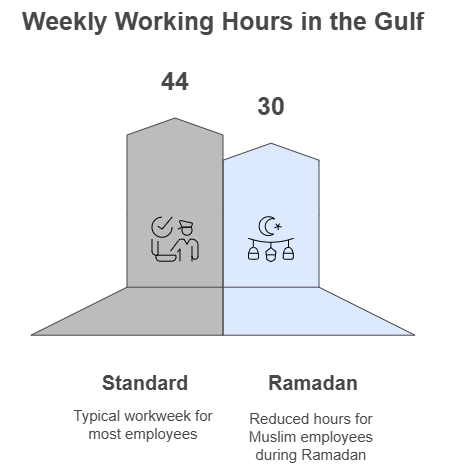

- Standard work hours? 40 to 48 hours per week (8 hours per day).

- Ramadan hours for Muslim employees? 6 hours per day.

- Overtime? Minimum 25% extra pay.

- Weekends? Friday & Saturday—welcome to the Gulf workweek!

If you’re running payroll and missing these details, you’re setting yourself up for some awkward (and expensive) corrections later.

In Summary: Don’t Wait for a Wake-Up Call

2025 is a year of change—and it’s not only about keeping up with the law. It’s about seizing the opportunity to streamline your operations, protect your company, and invest in your workforce. So, here’s the bottom line:

– Get ahead of nationalization requirements. It’s time to hire more locals and build a diverse, skilled workforce.

– Update your employee benefits and leave policies. If you’re not offering what the law mandates, fix it now.

– Be careful with terminations. Make sure your reasons are justifiable and your paperwork is in check.

– Clarify remote work policies and update contracts to reflect flexible working arrangements.

– Don’t let payroll slip. The WPS system is your friend, but it requires precision.

If you’re feeling overwhelmed, don’t panic—PEOs are your best friend in Bahrain. With their support, you’ll be equipped to handle whatever 2025 throws your way. You’ve got this. Contact us for our services.