Payroll management is the most complex and important function in any business. Have you ever thought about what would happen if a single error in salaries, allowances, or deductions occurred? It can affect employee trust. Even lead to compliance issues. This is where the payroll reconciliation process comes in as a savior! UAE businesses can ensure accuracy by carefully reviewing payroll data before disbursement. Not only this, but they are in a better position to comply with strict labor laws and build a transparent work culture.

Nowadays, companies rely more on digital tools. As a result, wage protection System (WPS) compliance and payroll reconciliation are no longer optional. This blog post breaks down everything you need. Explore why it matters, the steps involved, and how partnering with experts like PEO Middle East makes it easier! Let’s go and simplify.

Payroll Reconciliation in the UAE:

Need a procedure that double-checks everything, like your employee salaries, deductions, and allowances? Then, you need to upgrade to a process called payroll reconciliation.

The process of cross-checking salary records, allowances, and attendance data before releasing payments is called payroll reconciliation. Guaranteeing that every employee gets the right amount on time and the company stays compliant. You can think of it as a financial “health check” for your payroll system.

Why It Matters for Businesses?

UAE businesses must comply with the Wage Protection System and labor laws. If you have a well-managed payroll reconciliation process, then you’ll prevent errors. These errors often lead to fines, disputes, or employee dissatisfaction.

Further, it helps companies maintain financial accuracy. In actuality, it is critical when authorities or auditors request reports.

Payroll Reconciliation Process Steps:

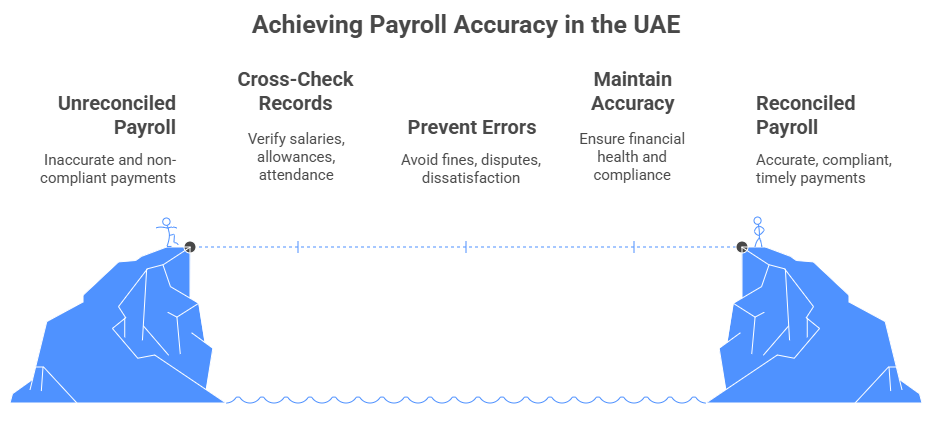

The payroll reconciliation process involves a series of structured steps designed to ensure accuracy, compliance, and transparency in employee salary management. The following key stages make up the process:

Gathering Payroll Data:

The first step is collecting data from different sources. This may include employee contracts, attendance systems, and benefits. The complete and updated information forms the foundation of accurate reconciliation.

Matching Records with Timesheets and Attendance:

The data needs to be compared with attendance records and timesheets when it is gathered. If an employee took unpaid leave, it should reflect in the final payroll. HR systems that are automated make this step smoother. They integrate attendance and payroll in real-time.

Verifying Deductions and Allowances:

Deductions must be carefully calculated. It can be loans, fines, or unpaid leaves. Similarly, allowances like housing and overtime need to be checked against employee contracts. This step ensures that payroll reflects both the legal and contractual obligations.

Finalizing and Approving Payroll Reports:

HR generates payroll reports for approval after all calculations. These reports highlight total expenses and compliance checks. It also indicates employee-wise breakdowns. Only after approval does payroll get uploaded to the WPS system for salary disbursement.

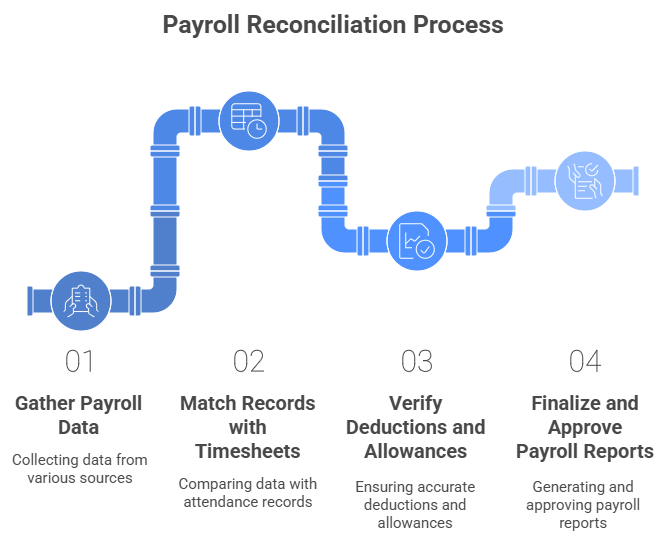

How Payroll Reconciliation Improves Accuracy?

A well-structured payroll reconciliation process is more than just a compliance requirement—it’s a safeguard for both businesses and employees. Here’s how it enhances payroll accuracy and reliability:

Eliminating Data Entry Errors:

Manual entry mistakes are common when payroll teams deal with spreadsheets. Reconciliation helps spot discrepancies, like an extra digit in a salary amount, before they turn into costly errors.

Preventing Overpayments and Underpayments:

Overpaying employees strains budgets, while underpaying creates dissatisfaction and legal issues. The payroll reconciliation process ensures every employee is paid the exact agreed-upon amount.

Supporting Transparent Employee Records:

Accurate payroll data creates transparent employee records, which can be used for promotions, end-of-service benefits, or dispute resolution. This builds trust between employees and employers.

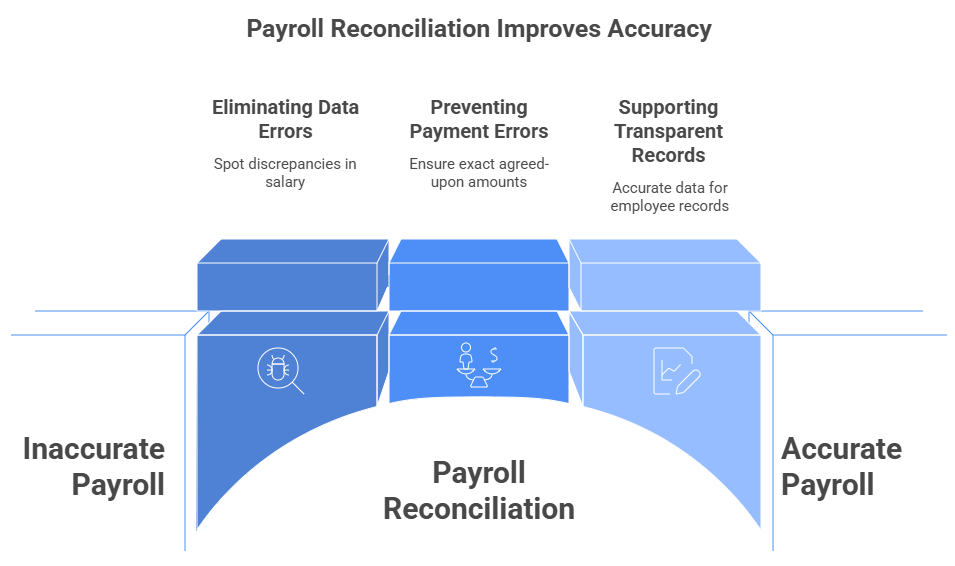

How Payroll Reconciliation Supports Compliance?

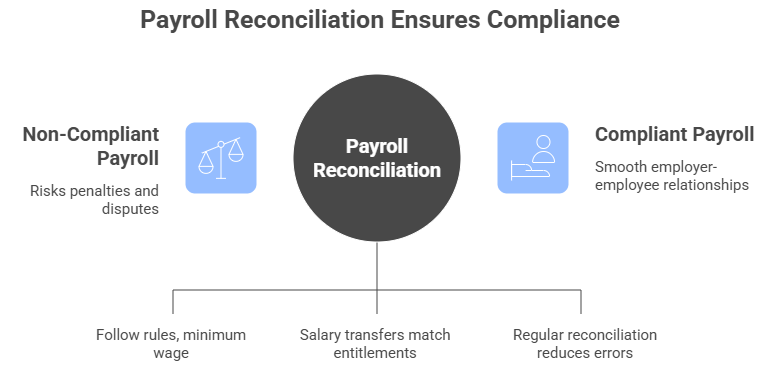

Payroll Reconciliation supports compliance in many ways. From aligning with UAE labor laws to meeting WPS to reducing the risk of penalties.

Aligning with UAE Labor Law Requirements:

Payroll reconciliation ensures companies follow the rules set under UAE labor law, such as minimum wage compliance, proper leave encashments, and gratuity settlements.

Meeting WPS (Wage Protection System) Regulations:

The UAE mandates salary transfers through WPS. Payroll reconciliation makes sure that amounts uploaded match employee entitlements, preventing rejections or penalties from the Ministry of Human Resources and Emiratisation (MOHRE).

Reducing Risks of Penalties and Disputes:

Errors in payroll not only risk fines but also lead to disputes with employees. Regular reconciliation reduces such risks, ensuring smooth employer-employee relationships.

Common Challenges in Payroll Reconciliation:

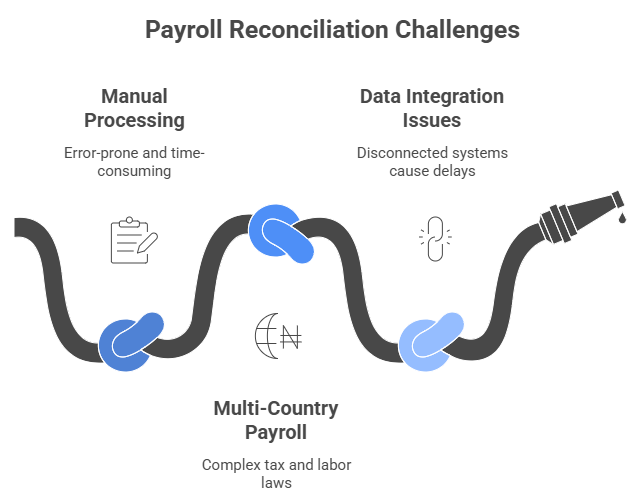

While payroll reconciliation delivers clear benefits in terms of accuracy and compliance, many organizations face obstacles when trying to implement it effectively. Understanding these challenges can help businesses prepare better solutions.

Manual Processing Limitations:

A large number of businesses still depend on spreadsheets for payroll management. This manual approach is not only time-consuming but also highly prone to human errors. Even a small mistake—such as misplacing a decimal—can lead to payroll discrepancies, frustrated employees, and additional administrative costs.

Multi-Country Payroll Complexities:

For global companies, payroll reconciliation becomes significantly more complex. Different tax regulations, multiple currencies, and varying labor laws across countries make accuracy harder to maintain. Without a streamlined system, payroll teams may struggle to stay compliant while ensuring employees are paid correctly and on time.

Data Integration Issues:

Another common challenge arises from disconnected HR, attendance, and payroll systems. When these systems don’t communicate effectively, payroll teams spend hours cross-checking data manually. Lack of integration not only slows down reconciliation but also increases the risk of inaccuracies and delays in salary processing.

How a PEO Partner Simplifies Payroll Reconciliation

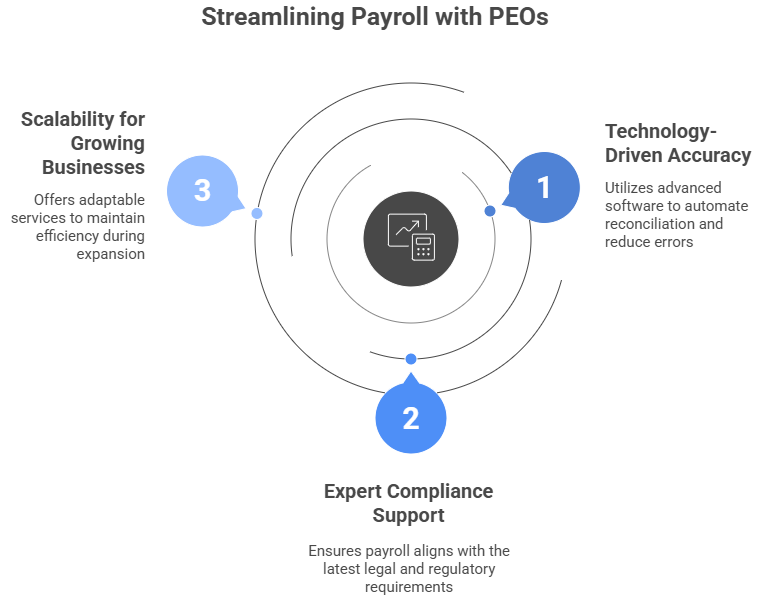

Many businesses wonder how a Professional Employer Organization (PEO) can streamline payroll reconciliation. By combining technology, compliance expertise, and scalable solutions, a PEO partner takes the complexity out of payroll management. Here’s how:

Technology-Driven Accuracy:

A trusted PEO partner—such as PEO Middle East—leverages advanced payroll software to automate reconciliation. This reduces the risk of human error, ensures consistency across employee records, and accelerates the entire payroll process.

Expert Compliance Support:

With frequent changes in UAE labor laws and wage protection regulations, staying compliant is a constant challenge for businesses. A PEO partner provides dedicated compliance support, ensuring payroll aligns with the latest legal and regulatory requirements.

Scalability for Growing Businesses:

As your workforce grows, so does the complexity of payroll reconciliation. A PEO offers scalable payroll services that adapt seamlessly to organizational growth, helping businesses maintain efficiency and accuracy at every stage of expansion.

PEO Middle East: Your Compliant Payroll Partner

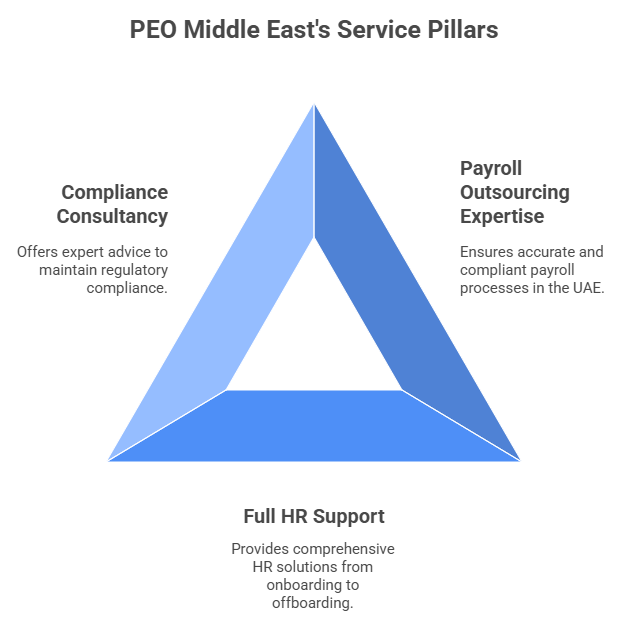

Selecting the right payroll management partner is one of the most important decisions for any business. At PEO Middle East, we combine accuracy, compliance, and end-to-end HR support to deliver payroll solutions that empower companies to grow with confidence.

Our Payroll Outsourcing Expertise in the UAE:

With deep experience in UAE payroll regulations, PEO Middle East ensures that every payroll process is handled with precision. From data collection and reconciliation to WPS submissions and detailed reporting, we manage the entire cycle—so you can focus on scaling your business.

Full HR and Compliance Support for Businesses:

Our services go beyond payroll. We offer full HR outsourcing, compliance consultancy, and employee lifecycle management solutions. Whether it’s onboarding, performance tracking, or end-of-service processing, PEO Middle East ensures your workforce operations remain efficient, transparent, and fully compliant.

Wrapping Up!

In conclusion, businesses can face many huge losses due to payroll errors. It can even cost them more than money. Payroll mistakes affect employee satisfaction and regulatory compliance. However, if you want an error-free payroll process, why not use the payroll reconciliation process? This gives UAE companies the confidence to pay employees accurately. In the meantime, they comply with laws and operate transparently.

Want to eliminate payroll stress and focus on business growth? PEO Middle East is here to support you. Contact us today and discover how our payroll solutions can streamline your reconciliation process.